CCH's new Tax Function Effectiveness addresses the unique challenges of tax function departments. The tax function's objectives should themselves be driven by what is happening in the business and the wider business and regulatory environment.

While the objectives of different tax functions will vary in the detail, we believe that the effectiveness of the tax function department is fundamentally based on its ability to achieve three core objectives:-

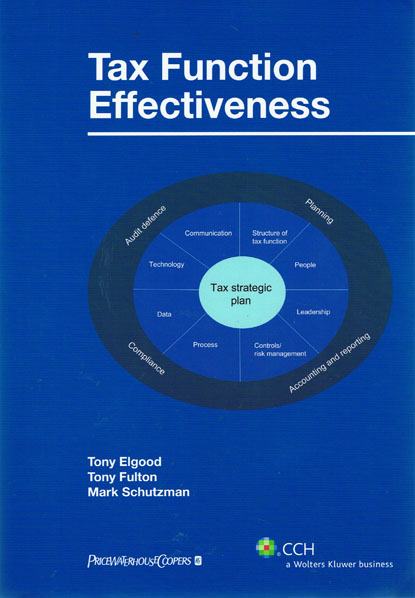

It is critical for the effectiveness of the tax function that an appropriate balance is reached between the achievements of the three core objectives set out above. This title contains an established tax management framework for how a tax function department should operate. The starting point is the tax strategic plan. For this plan to be implemented there are a number of enablers which need to be put in place.

The results of the plan, together with the enablers, are the various deliverables that are the outputs required for the successful management of the tax affairs of a business.