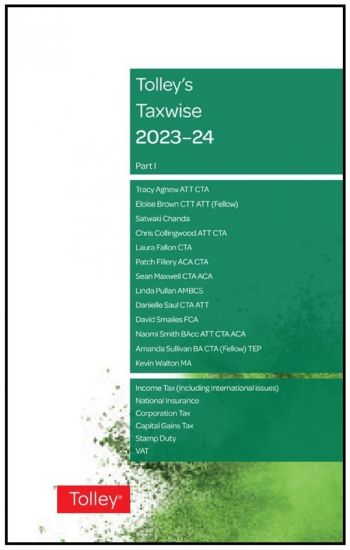

he first part of this two-volume set is a highly practical text on how to best approach real-life computations. Coverage includes IT, NIC, Corporation Tax, CGT, Stamp Taxes and VAT. Useful guidance tools include Q&As, cross-referencing and comprehensive indexing for fast, effective research. Worked examples are complemented by detailed explanatory notes and there are step-by-step guidelines on the layout of computations.